On-chain data shows Bitcoin long-term holders now hold 78% of the total circulating supply, the highest value the metric has ever seen.

Bitcoin Epe luzeko titularrak hornikuntza osoaren% 78an eserita daude

On analista batek adierazi duenez Twitter, the divergence between the long-term holders and the short-term holders is at its greatest right now. The epe luzeko titularrak (LTHak) eta epe laburreko titularrak (STH) Bitcoin merkatu osoa bana daitekeen bi edukitzaile talde nagusiak dira.

The STHs include all investors that bought their coins within the last six months, while the LTHs include those who acquired their BTC earlier than this threshold amount.

Estatistikoki, zenbat eta denbora gehiago eutsi inbertitzaileek txanponari, orduan eta aukera gutxiago izango dute edozein unetan saltzeko. Horrela, LTHek, oro har, txanponak lotan mantentzeko joera dute STHek baino denbora luzeagoan. Hori dela eta, LTHak Bitcoin merkatuko "diamante-eskuak" ere deitzen dira.

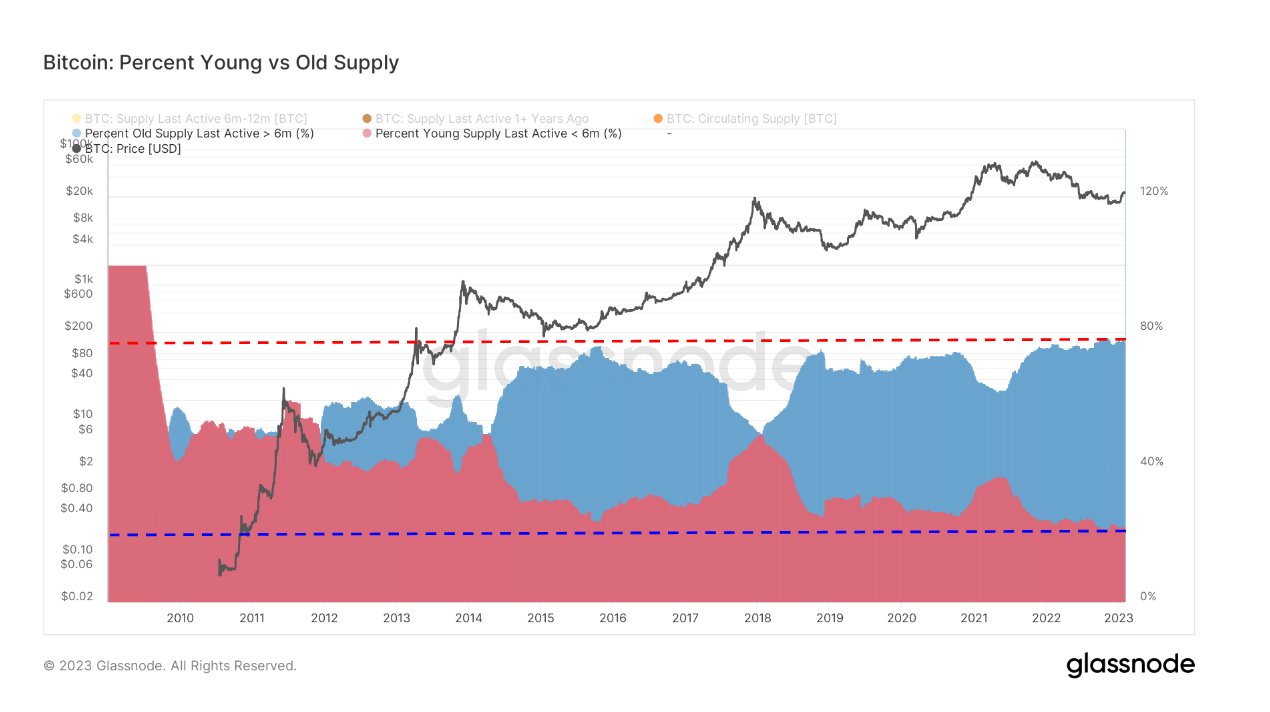

Now, the relevant indicator here is the “percent young vs old supply,” which measures what percentage of the total circulating BTC supply is currently being held by the STHs (the “young” supply) and what’s being held by the LTHs (the “old” supply).

Here is a chart that shows the trend in this Bitcoin metric over the entire history of the cryptocurrency:

The two supplies seem to have diverged away from each other in recent months | Source: Glassnode Twitter-en

As shown in the above graph, the percentage of the total Bitcoin supply held by the LTHs has only continued to go up for a couple of years now, suggesting that there has been a growing shift towards a HODLing mentality amongst the investors in the market.

While this has happened, the percentage contributed by the STH supply has naturally shrunk, as its value is simply calculated by subtracting the LTH percent supply from 100.

One recent brief decline was observed following the collapse of the kripto trukea FTX, eta horrek iradokitzen du istripuak merkatuko esku indartsuenei ere astindu ahal izan ziela. Hala ere, ez zen denbora luzez edukitzaileak arreta berreskuratu eta hornidura berriro ere goraka hasi zen arte.

After this latest accumulation by the cohort, the percentage of the supply held by them has reached a value of 78%. The STHs make up for the remaining 22% of the supply.

From the chart, it’s apparent that this divergence between the two Bitcoin supplies is at the greatest-ever level at the moment. This means that selling pressure from most of the supply should be the least ever now, as it is likely to remain dormant for extended periods with the LTHs.

Such a supply shock in the market can be bullish for the price of Bitcoin in the long term.

BTC Prezioa

Idazteko unean, Bitcoin 23,500 $ inguruan ari da negoziatzen, azken astean % 2 gehiago.

Looks like BTC has continued to consolidate in the last few days | Source: BTCUSD TradingView-n

Kanchanara-ren irudi aipagarria Unsplash.com-en, TradingView.com-en grafikoak, Glassnode.com-en

Iturria: https://bitcoinist.com/bitcoin-long-term-holders-hold-78-of-supply-highest/